Find future value of annuity

The tutorial explains what the present value of annuity is and how to create a present value calculator in Excel. In the United States an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

We get 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 ¹.

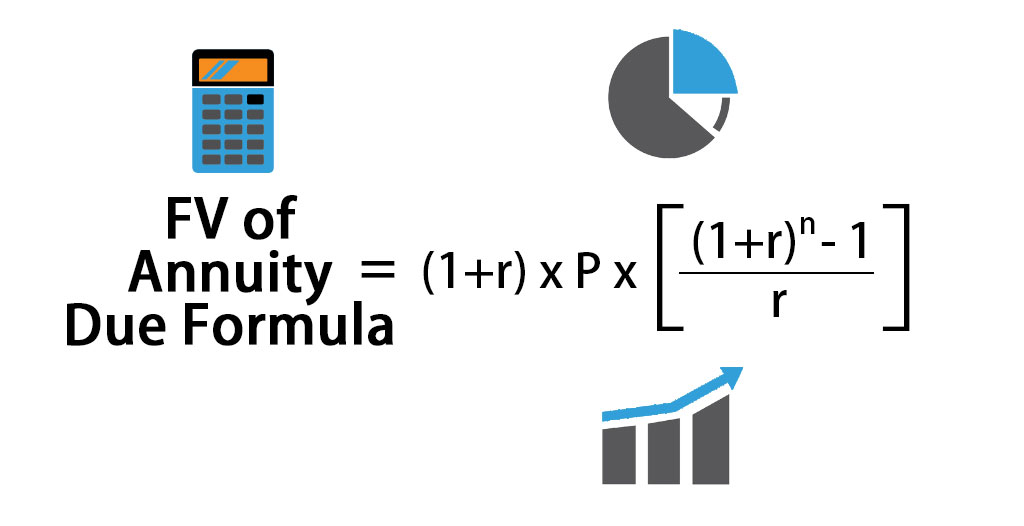

. Calculating the Future Value of an Ordinary Annuity. The primary benefits of buying an annuity include principal protection the potential for guaranteed lifetime income and the option to leave money to your beneficiaries. It is possible for the total value of assets in a variable annuity to be lower.

Excel can be an extremely useful tool for these calculations. Typically these are offered as structured products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurerThere are many different varieties of. Future Value Annuity Formula Derivation.

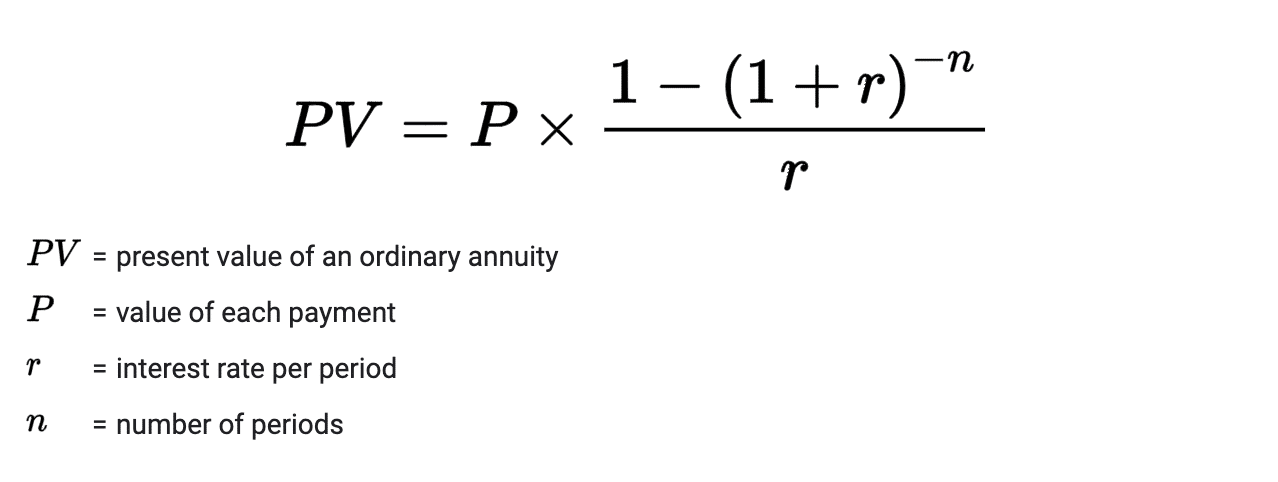

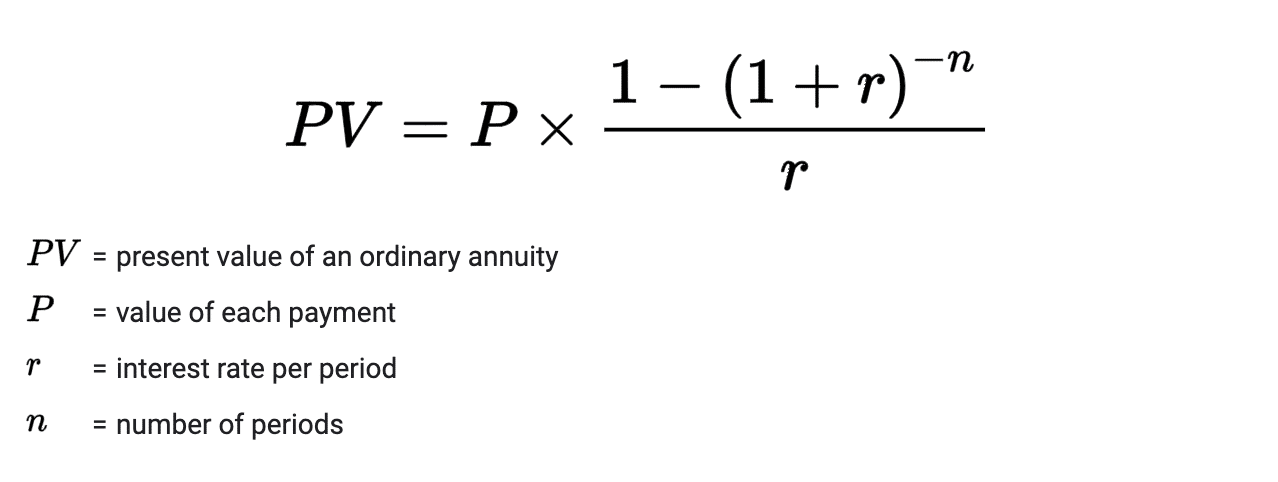

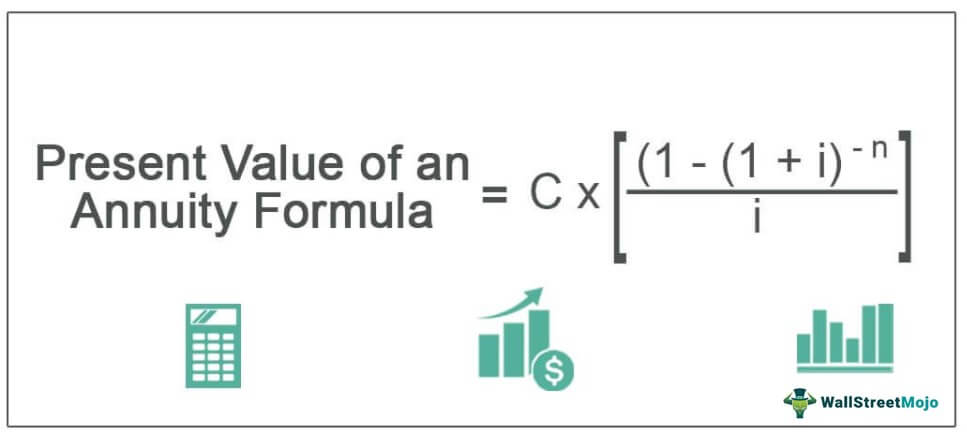

Thus this present value of an annuity calculator calculates todays value of a future cash flow. The basic annuity formula in Excel for present value is PVRATENPERPMT. Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest.

Contact us today to get started securing your future with an annuity and let us help you navigate through all the numbers. Present Value Of An Annuity. You can find derivations of future value formulas with our future value calculator.

Accumulation Value Current Account Value. This formula relies on the concept of time value of money. This is because the payments you are scheduled to receive at a future date are actually worth less than the.

PVOA APr 1 - 11 rN - If due then the formula is. For a lump sum investment that will pay a certain amount in the future define the future value B5. Annuity Due Payment - Future Value FV Calculator.

Earnings in annuities grow and compound tax-deferred which means that the payment of taxes is reserved for a future time. Some annuities may also be optimized to help pay for long-term care. Present value is linear in the amount of payments therefore the present.

An annuity table or present value table is simply a tool to help you calculate the present value of your annuity. Some also offer additional liquidity options if certain conditions are met either due to an extended nursing home stay or a significant health event that results in the inability to complete two out of the six activities of daily living. In other words the purchasing power of your money decreases in the future.

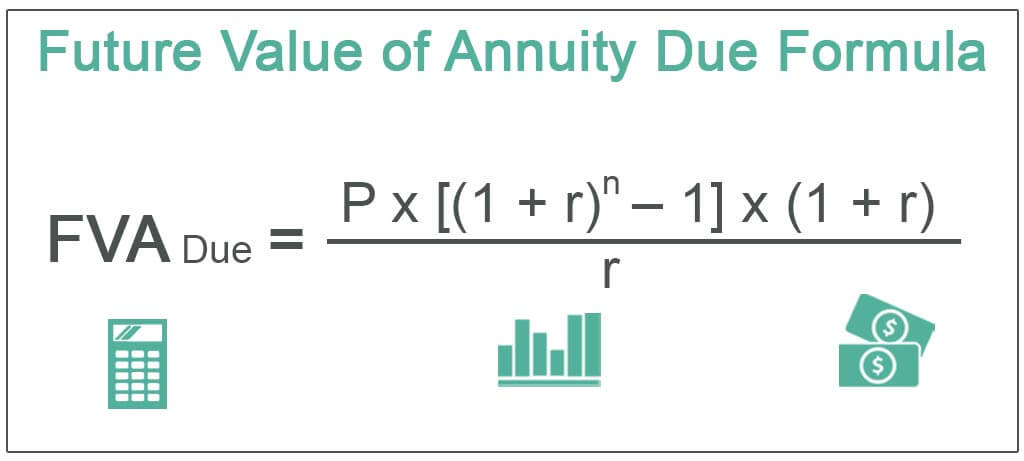

The present value is given in actuarial notation by. Excel can perform complex calculations and has several formulas for just about any role within finance and banking including unique annuity calculations that use present and future value of annuity formulas. The present and future values of an annuity due can be computed as follows.

Time value of money is the concept that a dollar received at a future date is worth less than if the same amount is received today. Annuity Due Payment - Present Value PV Calculator. Future Value Annuity Formulas.

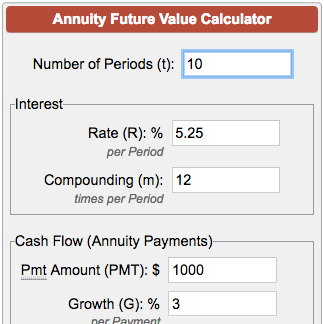

The present value annuity factor is used to calculate the present value of future one dollar cash flows. Assume that in the example above the annuity payment is to be received at the beginning of each year. The algorithm behind this future value of annuity calculator applies the equations detailed here.

An annuity is a sum of money paid periodically at regular intervals. PV formula examples for a single lump sum and a series of regular payments. The type of annuity you purchase determines your future annuity payments.

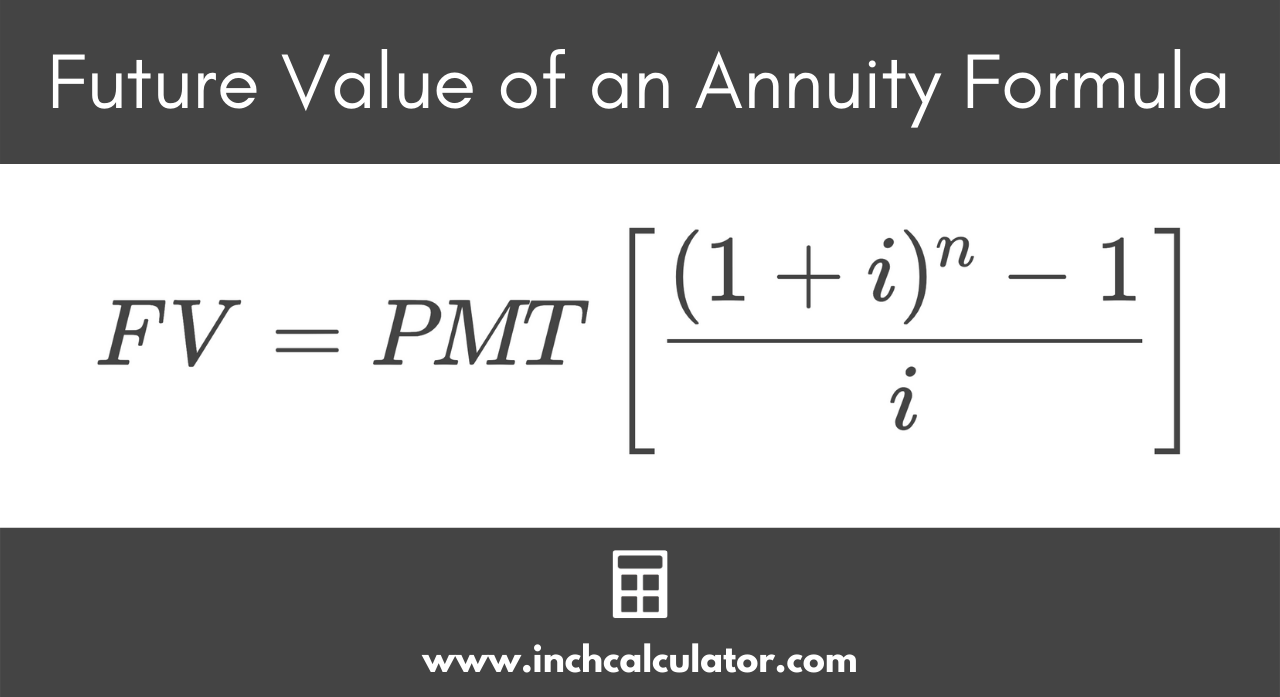

For an annuity spread out over a number of years. Lets assume we have a series of equal present values that we will call payments PMT and are paid once each period for n periods at a constant interest rate iThe future value calculator will calculate FV of the series of payments 1 through n using formula. To understand the computation of the present value of a series of payments to be received in future read present value of an annuity article.

Most people use annuities as supplemental investments in combination with other investments such as IRAs 401ks or other pension plans. PV due PV ord 1 r PV due. The program uses this value to calculate the annuity payout the present value of the annuity payments and the present value of the remainder for gift tax purposes.

Well work with you to find the best value for your needs and ensure you are confident in your purchase. Where is the number of terms and is the per period interest rate. Based on the time value of money the present value of your annuity is not equal to the accumulated value of the contract.

FV function returns an incorrect future value. Annuity Payment - Future Value FV Calculator. Present Value of Annuity PV is estimated by taking account of the annuity type - If ordinary then the formula is.

The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Present Value PV of Annuity Due Comparing annuity due with ordinary annuity we can find the following relationship. This is also called discounting.

If the returned future value is negative or much lower than expected most likely either the pmt or pv argument or both are represented by positive numbers. Thats how to how to calculate future value of annuity in. Use equation 3 to multiply by 1i.

Future Value of an Annuity FVdfracPMTi1in-11iT where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m is the compounding frequency per period t. PV due Present value of annuity due. Discounted Fair Market Value.

The PV will always be less than the future value that is the sum of the cash flows except in the rare case when interest rates are negative. Please remember that negative numbers should be used for all outgoing payments. FV due Future value of annuity due.

The Present Value of Annuity Calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. Enter the gift tax value of contributed principal after appropriate discounts such as minority interests or lack of marketability. Many fixed and fixed index annuities include the ability to access funds penalty-free if you need to without incurring a surrender charge.

The annuity may be either an ordinary annuity or an annuity due see below. The future cash flows of. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

Then the present value of the annuity will be. Use our annuity value calculator to get estimates. By looking at a present value annuity factor.

PV annuity due PV ordinary annuity u 1 i 5 The detailed proof of equation 5 is shown in Appendix B. To find out the present value the amount of 5000 to be received in future would be discounted using.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Future Value Of An Annuity Formula Example And Excel Template

Present Value Of An Annuity How To Calculate Examples

How To Measure Your Annuity Due

Future Value Of Annuity Due Formula Calculator Excel Template

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Future Value Of Annuity Formula With Calculator

Future Value Of Annuity Due Formula Calculation With Examples

Annuity Formula What Is Annuity Formula Examples

Future Value Of An Annuity Calculator Inch Calculator

How To Calculate The Present Value Of An Annuity Youtube

Formula Of Future Value Sale Online 51 Off Www Wtashows Com

Formula Of Future Value Store 55 Off Www Wtashows Com

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Future Value Of Annuity Calculator

How To Calculate The Future Value Of An Ordinary Annuity Youtube

Excel Formula Future Value Of Annuity Exceljet